The Krutham Africa Impact Investment Awards, sponsored by FirstRand, recognise success in the rapidly growing impact investing industry. They celebrate outstanding achievements and contributions that drive positive social and environmental change while creating value for investors in Africa.

Social enterprise of the year:

Awarded to social enterprises, i.e. businesses that aim to generate profit and have positive social or environmental impact, that are solving some of the continent’s most entrenched social or environmental problems.

Impact funder of the year:

Funders deploying capital to support impact projects. Can include pension funds, endowments, corporations, banks, governments, development finance institutions, high net-worth individuals, and public funders will be eligible for consideration. The award will seek to highlight funders who opted for a non-traditional funding approach, either as a provider of catalytic capital or a third party investor deploying capital into an innovative structure.

Financial structure of the year:

This award is specifically for the innovative financial structures using new instruments and other mechanisms for impact investments. Innovations can include funding instruments or structures, impact delivery mechanisms and innovation in lending schemes to targeted beneficiaries.

Impact fund of the year:

This award recognises fund managers who have excelled with a dedicated impact investment fund within their investment house.

Impact intermediary of the year:

This award recognises intermediaries that support and enable impact investing, including arrangers, accelerators, incubators, government departments, research & consulting firms, policy think-tanks or professional services companies that promote impact investments through thought leadership, project implementations and advisory work.

Outstanding individual achievement of the year:

This award is for an individual that has made an outstanding contribution in the past year to support the growth of the impact investments ecosystem.

Impact funder of the year

| Winner | Phatisa Click here to download the case study. |

| 2nd Place | Alitheia Capital |

| 3rd Place | Oryx Impact |

Impact fund of the year

| Winner | Inspired Evolution (Evolution III) Click here to download the case study. |

| 2nd Place | Sahel Capital |

| 3rd Place | Alitheia Capital |

Impact intermediary of the year

| Winner | Africa GreenCo Click here to download the case study. |

| 2nd Place | Value for Women |

| 3rd Place | FyreFem Fund Managers |

Financial structure of the year

| Winner | Villgro Africa Click here to download the case study. |

| 2nd Place | RMB – Rwanda SLB |

| 3rd Place | RMB – KOKO Networks |

Social enterprise of the year

| Winner | eBee Africa |

| 2nd Place | Onyx Connect |

| 3rd Place | SV Capital |

Judges’ Award

| Winner | 60 Decibels Click here to download the case study. |

| 2nd Place | Sahel Capital Click here to download the case study. |

Outstanding Individual Achievement of the Year

| Winner | Amma Lartey Click here to download the case study. |

| 2nd Place | Marike Fourie and Wyson Lungo |

2024 Awards Report

These awards shine a spotlight on excellence in impact investments.

The UN estimates that USD2.5 trillion in yearly spending is required to meet the Sustainable Development Goals each year until 2030. Currently, development funding globally is USD158 billion. This sum, although very sizeable, is not enough but can be re-purposed as catalytic capital to unlock USD212 trillion in private markets. Impact investing is one effective way of attracting private capital to augment development funding.

Impact investments are made with the aim of generating positive, measured social and environmental impact alongside a financial return.

Although the practice is relatively new, there is already a high level of interest among traditional and social investors. But many actors in this space operate with limited connection to others. Similarly, except for impact investing practitioners – those actively designing, investing in or participating in impact investments and those who have an active interest in the field – knowledge is limited. This is true for stakeholders in government, civil society, the media, the broader public and the investment community.

The awards serve to showcase a new world of possibilities to investors and those who are considering it. This in turn could facilitate greater access to capital, particularly for smaller social enterprises. Governments on the continent benefit from additional capital to support their development objectives.

- Recognise impact practitioners for their valuable work;

- Build knowledge and interest in impact investing among diverse audiences – particularly governments, civil society, the media, and the investment community;

- Inspire those in the investment community to become more involved in the design and participation in impact investments; and

- In the longer term, as methodologies are repeated and strengthened, the awards will help standardise how we view and evaluate the very nebulous concept of impact.

FirstRand is a group of integrated financial services businesses that encourages innovation and rewards different thinking from its people. We are one of the largest banking groups in Southern Africa and we are active in several other markets across Africa and in the United Kingdom. We recognise our responsibility to deliver both financial value and positive social outcomes and have embedded shared value in our strategy and operations.

We are pleased to sponsor the Krutham African Impact Investment Awards case studies series to showcase financial innovation that tackles social and environmental challenges on our home continent. The awards draw out excellence, providing examples for others emulate, showing what is possible when investors work with social entrepreneurs, governments and communities to deliver change. Our strategy encourages innovation that solves our challenges, and we are pleased to support thought leadership on impact investing in Africa.

See more about FirstRand’s contract with society here.

We use the Global Impact Investing Network’s definition of impact investments:

“Investments made with the aim of generating positive, measured social and environmental impact alongside a financial return.”

This excludes the following types of activities for awards consideration:

- Corporate social responsibility (CSR) initiatives.

- Investments with potential social or environmental benefits that are not explicitly planned for and measured.

- Investments in social and environmental causes that do not also carry financial returns for investors.

- Originality of design (10 points)

- The extent to which an unmet need is filled (10 points)

- Impact (30 points)

- Financial performance (30 points)

- Potential for replicability of the instrument or transferability to other sectors (20 points)

When workshopping to finalise these criteria, a key point to consider will be the extent to which projects that are still in their early stages should be considered for awards. Such projects would then be evaluated along planned impact and financial performance criteria.

Each application will be awarded a maximum of 100 points. Winners in each category will be chosen according to applications with the highest average score.

1. Can I self-nominate for more than one award?

Yes. When you complete the nomination form you will be asked if you would like to submit a nomination for more than one award.

2. Can I nominate someone else?

Yes. You can simply share the nomination form with them. The link can be found here.

3.When is the closing date for nominations?

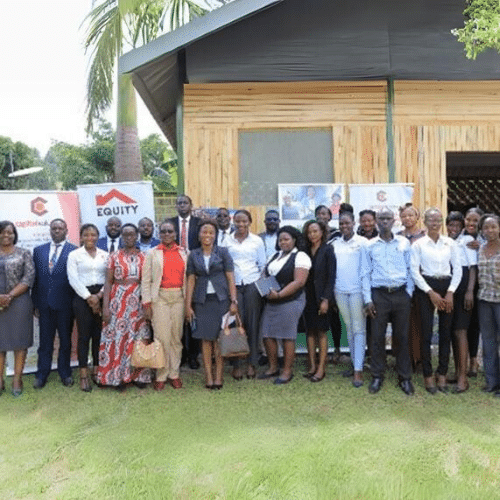

Nominations close on 7 April. The winners will be announced in July 2024 at a gala dinner event in Nairobi, Kenya

4. Do I have to be based in Africa to submit a nomination?

Nominees can be registered in any African country, headquartered on the continent, or only have operations in one of the countries on the continent to qualify. We welcome investors across asset classes and across impact sectors which operate anywhere in Africa.

5. How will I know if my nomination was successful?

Shortlisted nominees will be notified before the end of May

6. When will the winners be announced?

Winners will be announced in Q2 2024.

7. Where and when will the awards take place?

The awards will be hosted online.

Below we present case studies on the 11 winners and 9 runner-ups of this year's awards (see the category descriptions below). We will add further case studies soon, so stay in touch for the latest updates.

Catalytic Investor of the Year: SAB Foundation

SAB has three programmes including a finance impact for loan fund

Catalytic Investor of the Year: Innovation Edge

Innovation Edge addresses critical challenges in the ECD sector by focusing its investments and support on start-up or early-stage ventures that are positioned to transform children’s lives.

Financial Instrument of the Year: The Impact Bond Innovation Fund

A social impact bond for better early childhood development outcomes.

Financial Instrument of the Year: 27four Investment Managers

Blended finance solution to deliver both commercial returns and impact such as job creation, transformation and economic growth for investors.

Impact Accelerator of the Year: LEAP Africa Social Innovators Programme

Equips African innovators with the necessary skills, resources and connections to grow.

Impact Accelerator of the Year: Capital Solutions Ltd

Capacitating social entrepreneurs working with low-income communities in Africa.

Impact Asset Manager of the Year: Vital Capital

Turning critical challenges associated with the provision of water, food, healthcare and sustainable infrastructure into high-return opportunities that deliver impact at scale.

Impact Asset Manager of the Year: Phatisa (NB IMM framework)

With nearly half a billion dollars under management, Phatisa distinguishes itself by refusing to see a trade-off between impact and returns. The ampersand (&) at the heart of its brand embodies this core principle.

Impact Asset Owner: Old Mutual

Old Mutual invests in impact initiatives related to infrastructure, affordable housing, schools and agriculture.

Impact Fund of the Year: Yunus Social Business

Empowers local social businesses in East Africa that provide employment, education, healthcare, clean water and clean energy.

Impact Fund of the Year: Alitheia Capital

Africa’s first and largest gender-lens investment private equity fund.

Impact Market Builder of the Year: IBIS Consulting

Impact investing advisory and support that helps clients achieve their impact goals.

Impact Market Builder of the Year: Impact Investing Ghana

Impact Investing Ghana is an independent cross-sector initiative that promotes sustainable development and advances the development of the impact investment ecosystem in Ghana.

Outstanding Individual Achievement: Evelyne Dioh

Sits on several boards of local businesses and on the investment committee of two investment funds.

Outstanding Individual Achievement: Zanele Twala & Justin Prozesky

Project Developer of the Year: eha Impact Ventures

Investing in women-led businesses for impact.

Project Developer of the Year: Impact For Africa S.p.A.

Impact investment in frontier markets and undeveloped value chains and bottlenecks.

Social Entrepreneur of the Year: Lumkani

Seeks to address the challenge of fires in informal settlements.

Social Entrepreneur of the Year: Ilara Health

Innovative solutions to Africa’s healthcare challenges and needs.

Special consideration: XSML

With a focus on Central Africa XSML Capital has invested in more than 70 enterprises and covered assets of $159m. Its investment teams in Angola, DRC and Uganda help to grow small businesses to become medium and large enterprises by providing tailored financing and expertise.

Catalytic Investor of the Year

Winner | SAB Foundation, South Africa – funds and supports entrepreneurs, emphasises creating opportunities for women, youth, rural communities and persons with disabilities. |

2nd Place | Innovation Edge, South Africa |

3rd Place | FirstRand Foundation, South Africa |

Financial Instrument of the Year

Winner | Impact Bond Innovation Fund, Standard Bank Tutuwa Community Foundation, South Africa – one of the first social impact bonds transacted in South Africa with a bond aimed at delivering early childhood development outcomes in the Western Cape. |

2nd Place | 27four Investment Managers, South Africa |

3rd Place | Rand Merchant Bank, South Africa |

4th Place | Oryx Impact Fund, Nigeria. |

Impact Accelerator of the Year

| Winner | LEAP Africa, Nigeria – a social innovators programme that provides skills, resources and connections for young innovators to create lasting solutions to community challenges, such as interventions that help to build sustainable systems and structures; focused on education, agriculture/food security, renewable energy/sustainable environments, education and technology, etc. |

| 2nd Place | Capital Solutions Ltd, Uganda Click here to download the case study. |

| 3rd Place | TAOTIC, Tanzania |

Impact Asset Manager of the Year

Winner | Vital Capital, Uganda – identifies overlooked opportunities and builds scalable businesses that transform lives and turn critical challenges associated with the provision of water, food, healthcare and sustainable infrastructure into high-return opportunities that deliver impact at scale. |

2nd Place | Phatisa, Mauritius |

3rd Place | AlphaMundi Group, Kenya |

Impact Asset Owner of the Year

Winner | Old Mutual, South Africa – pursues long-term risk-adjusted returns for clients while aligning with the broader interests of society and addressing long-term systemic risk; drives real-world outcomes in the form of impact. |

2nd Place | Impact For Africa S.p.A., Rwanda/Namibia |

3rd Place | Venture Capital Trust Fund, Ghana |

Impact Fund of the Year

Winner | Yunus Social Business, Kenya – finances and grows social businesses to end poverty and the climate crisis; provides flexible loans and hands-on growth support to social businesses and reinvests the capital; provides debt capital at concessionary rates in local currency and USD to social businesses. |

2nd Place | Alitheia Capital, Nigeria |

3rd Place | Jaza Rift Ventures, Kenya |

Impact Market Builder of the Year

Winner | IBIS Consulting, South Africa – helps clients achieve their impact goals through an integrated approach to impact investing advisory and support; maximises the impact created by clients by providing customised solutions and leveraging best practice methodologies and frameworks. Click here to download the case study. |

2nd Place | Impact Investing Ghana, Ghana |

2nd Place | Data Innovators, South Africa |

3rd Place | Prospero, Zambia |

Outstanding Individual Achievement of the Year

Winner | Evelyne Dioh, WIC Capital, Senegal – fund manager and managing director of WIC Capital, the first investment fund in West Africa that exclusively targets women-led small and growing businesses to unlock their full potential. Click here to download the case study. |

2nd Place | Zanele Twala & Justin Prozesky, Standard Bank Tutuwa Community Foundation, South Africa |

3rd Place | Gwendolyn Zorn, Phatisa, Mauritius |

4th Place | Uche Kenneth Udekwe, Natal Cares, Nigeria |

Project Developer of the Year

Winner | eha Impact Ventures, Nigeria – philanthropic impact investor that supports early stage, high-impact, women-led businesses in Africa. Click here to download the case study. |

2nd Place | Impact For Africa S.p.A., Rwanda/Namibia |

3rd Place | Food Enterprise Solutions, Senegal |

Social Entrepreneur of the Year

Winner | Lumkani, South Africa – insuretech company dealing with the challenge of informal settlement fires through risk-reducing technology and affordability; developer of an award-winning fire detection system. Click here to download the case study. |

2nd Place | llard Health, Kenya |

3rd Place | AbuErdan, Egypt |

4th Place | Yebo Fresh, South Africa |

Special Consideration Award

Winner | XSML Capital, Democratic Republic of Congo – partners in growth for entrepreneurs in frontier markets in Africa; provides expertise, network and bespoke financing to nurture local talent and bring durable and fair prosperity to under-served markets; since 2010 has invested in SMEs in challenging markets; invested in more than 70 enterprises and covered assets of $159 million. |

For questions or comments email us at [email protected].

Talk to us about how we can position your brand on our global platform and enable your business. Contact Dr Stuart Theobald at [email protected].

The benefits include:

Brand eminence. Impact investments are an innovative approach to solving complex problems. The awards allow your firm to align your brand with innovators and pioneers working at the cutting edge of finance and development.

Strategic alignment. Impact investments are inherently sustainable because they deliver value for entrepreneurs, investors, governments and communities. The awards are an opportunity to demonstrate your commitment to sustainable change on the continent.

Build a network. The awards span the entire African continent, and we’re connecting all the role players.

Meet new clients. Showcase your solutions and expertise to boost your business development.

Investment pipeline. Through rounds of investment and exits, social entrepreneurs offer investors unique investable opportunities. The awards will showcase flourishing impact investment ecosystem within African countries and across the continent.

Crowd-in capital. Governments in Africa are capital constrained and need access to private capital to enable development. The awards will support effort to unlock more capital to boost development and reduce risk for all investors and stakeholders.

Add your support to the awards. Contact us at [email protected].